Whittier, California – Friendly Hills Bancorp (the “Company”) (OTC Pink: FHLB), the holding company for First Pacific Bank (the “Bank”), today reported consolidated results for the first quarter ending March 31, 2023, driven by solid organic loan and deposit growth and improved operating performance. As previously reported on April 7, 2023, the Company has maintained a strong capital and liquidity position, centered in a growing core deposit base, with access to significant liquidity resources.

Highlights:

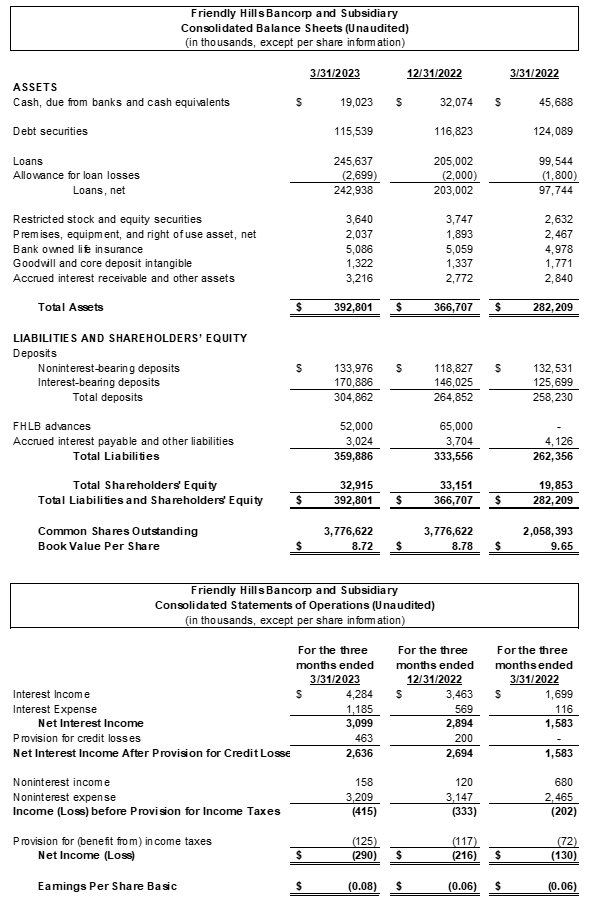

- Total assets ended Q1 2023 at $393 million, up from $367 million at year end 2022.

- Total deposits ended the first quarter at $305 million, increasing $40 million or 15% since year end 2022, $17 million of this increase was during the month of March 2023.

- Total loans ended the first quarter at $246 million, increasing $41 million or 20% since year end 2022.

- Asset quality remains excellent, and we have experienced no significant changes in classified assets or non-performing assets.

- The Bank ended the first quarter with a leverage capital ratio of 8.55% and total risk-based capital ratio was 11.69%, considered “well-capitalized” – the highest regulatory capital category.

- At March 31, 2023, cash and cash equivalents totaled $19 million, including overnight funds.

- Unused borrowing capacity from credit facilities in place at March 31, 2023, totaled over $110 million.

- Net interest margin held steady at 3.55% in Q1 versus 3.58% in Q4 2022 and up from 2.44% in Q1 2022.

For the first quarter ended March 31, 2023, the Company realized operating pre-tax, pre-provision profit of $48 thousand, compared to operating pre-tax, pre-provision profit of $40 thousand in Q4 2022. Operating pre-tax, pre-provision profit is before income taxes, before the provision for loan losses expense, and in Q4 2022 excludes a non-recurring write-down on leased space and other assets that are no longer in use. Loan growth continues to drive significant improvement in net interest income, which increased $205 thousand, or 7.1% in the first quarter of 2023 compared to the fourth quarter of 2022.

The provision for credit losses of $463 thousand in Q1 2023 relates entirely to growth in the loan portfolio and is in addition to $236 thousand added during the quarter as the Bank implemented new accounting pronouncements for allowances for credit losses. Asset quality remains excellent with zero non-performing assets and the allowance for credit losses is 1.10% of total loans.

“First Pacific Bank delivered solid results in the first quarter during a period of heightened financial market volatility. Our capital, liquidity, and financial position remain strong, and we are well-positioned to deliver for our clients and communities through the current environment and beyond,” said Joe Matranga, Chairman of the Board of Directors.

“Continuing on our momentum, we produced strong financial performance during the first quarter, further demonstrating our strength and stability despite the market disruption” commented Nathan Rogge, President and Chief Executive Officer. “We delivered significant loan and deposit growth, improved operating results, and maintained excellent asset quality. As we look ahead, we are committed to executing our strategic plan to drive long-term sustainable growth while delivering value for our stakeholders,” Rogge concluded.

ABOUT FIRST PACIFIC BANK

First Pacific Bank, formerly known as Friendly Hills Bank, is a wholly owned subsidiary of Friendly Hills Bancorp (OTC Pink: FHLB), and is a growing community bank catering to individuals, professionals, and small-to-medium sized businesses throughout Southern California. With a history that spans 16 years, the Bank offers a personalized approach, access to decision makers, a broad range of solutions, and a commitment to delivering an exceptional customer experience. First Pacific Bank operates locations in Los Angeles County, Orange County, San Diego County, and the Inland Empire. For more information, visit www.firstpacbank.com or call 888.BNK.AT.FPB.

FORWARD-LOOKING STATEMENTS

This news release may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, and Friendly Hills Bancorp intends for such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Future events are difficult to predict, and the expectations described above are necessarily subject to risk and uncertainty that may cause actual results to differ materially and adversely. Forward-looking statements relate to, among other things, our business plan, expectations and strategies, including, but not limited to, our expansion in the San Diego market, and can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and similar expressions. These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Factors that might cause such differences include, but are not limited to: the effects of the Covid-19 pandemic; successfully realizing the benefits of our business strategy and plans,; changes in general economic and financial market conditions, either nationally or locally, in areas in which First Pacific Bank conducts its operations; effects of inflation and changes in interest rates; continuing consolidation in the financial services industry; new litigation or changes in existing litigation; increased competitive challenges and expanding product and pricing pressures among financial institutions; impact of any natural disasters, including earthquakes; effect of governmental supervision and regulation, including any regulatory or other enforcement actions; legislation or regulatory changes which adversely affect First Pacific Bank’s operations or business; loss of key personnel; and changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies. The Company does not undertake, and specifically disclaims any obligation to update any forward-looking statements to reflect occurrences or unanticipated events, or circumstances after the date of such statements except as required by law.

— Summary Financial Table Follows —