Whittier, California, October 30, 2023 – First Pacific Bancorp (the “Company”) (OTC Pink: FPBC), the holding company for First Pacific Bank (the “Bank”), today reported consolidated results for the third quarter ending September 30, 2023, including another quarter of a return to profitability. The Company continues to maintain a strong capital and liquidity position, centered on a growing core deposit base, and access to significant liquidity resources.

Highlights:

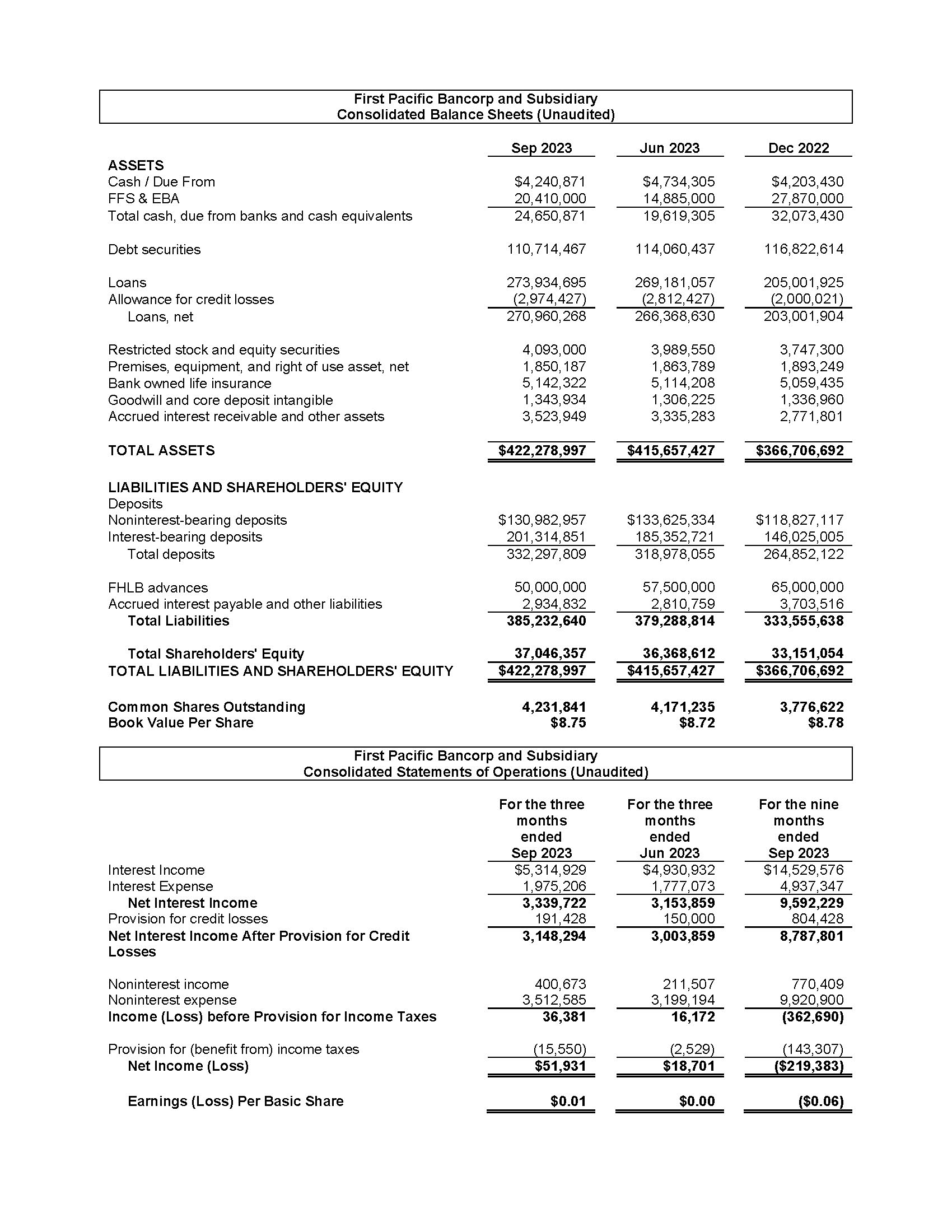

- Total assets ended Q3 2023 at $422 million, an increase of $6 million from the prior quarter, up $55 million from $367 million at year end 2022, and up $93 million from September of 2022.

- Total deposits ended the third quarter at $332 million, increasing $13 million from the prior quarter and $67 million since year end 2022.

- Total loans ended the third quarter at $274 million, increasing $5 million from the prior quarter and $69 million since year end 2022.

- Asset quality remains excellent, and we have experienced no significant changes in classified assets or non-performing assets.

- The Bank ended the third quarter with a leverage capital ratio of 8.72% and total risk-based capital ratio was 12.02%, considered “well-capitalized” – the highest regulatory capital category.

- As of September 30, 2023, cash and cash equivalents totaled $25 million, including overnight funds invested.

- Unused borrowing capacity from credit facilities in place at September 30, 2023, totaled over $140 million.

- Net interest margin was 3.30% in Q3, up from 3.23% in Q2 2023, but down from 3.36% in Q3 2022.

For the third quarter ended June 30, 2023, the Company realized a pre-tax pre-provision profit of $228 thousand, compared to a pre-tax pre-provision profit of $166 thousand in Q2 2023. Net income for the third quarter of 2023 was $52 thousand. Quarterly net interest income increased by $186 thousand compared to Q2 2023 as growth and increasing yield on assets more than offset increasing funding costs in a competitive marketplace.

The provision for credit losses of $191 thousand in Q3 2023, and $804 thousand for the nine months ending September 30, 2023, relates entirely to growth in the loan portfolio and is in addition to $236 thousand added at the beginning of the year from implementing new accounting pronouncements for allowances for credit losses. Asset quality remains excellent with minimal non-performing assets and the allowance for credit losses is 1.09% of total loans.

“First Pacific Bank continues to report solid financial results through a dynamic market environment. Our capital, liquidity, and financial position remain strong, and we are pleased with the additional support demonstrated by the private placement of common shares at $8.25 per share, which has grown to a cumulative total of $3.75 million through September 30, 2023,” said Joe Matranga, Chairman of the Board of Directors.

“Our relationship-focused business model continues to serve us well. We have been successful in growing our client base by pursuing underserved industries, emphasizing our commitment to service, access to decision-makers, and competitive rates, including our high Earnings Credit Rate on our Commercial Analyzed Checking account, which we believe is the strongest in the region,” commented Nathan Rogge, President and Chief Executive Officer. “As we look ahead, we remain well-positioned to drive responsible growth and deliver long-term value to all of our stakeholders,” Rogge concluded.

During the third quarter, the Bank realized significant operational efficiencies and made meaningful progress towards accomplishing our goal of streamlining processes designed to further enhance the client experience. Additionally, the Company implemented the previously announced name change from Friendly Hills Bancorp to First Pacific Bancorp and simultaneously changed the ticker symbol of the common shares quoted on OTC Markets Pink to FPBC.

ABOUT FIRST PACIFIC BANK

First Pacific Bank, formerly known as Friendly Hills Bank, is a wholly owned subsidiary of First Pacific Bancorp (OTC Pink: FPBC), and is a growing community bank catering to individuals, professionals, and small-to-medium sized businesses throughout Southern California. With a history that spans 17 years, the Bank offers a personalized approach, access to decision makers, a broad range of solutions, and a commitment to delivering an exceptional customer experience. First Pacific Bank operates locations in Los Angeles County, Orange County, San Diego County, and the Inland Empire. For more information, visit www.firstpacbank.com or call 888.BNK.AT.FPB.

FORWARD-LOOKING STATEMENTS

This news release may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, and First Pacific Bancorp intends for such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Future events are difficult to predict, and the expectations described above are necessarily subject to risk and uncertainty that may cause actual results to differ materially and adversely. Forward-looking statements relate to, among other things, our business plan, and strategies, and can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and similar expressions. These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Factors that might cause such differences include, but are not limited to: successfully realizing the benefits of our business strategy and plans,; changes in general economic and financial market conditions, either nationally or locally, in areas in which First Pacific Bank conducts its operations; effects of inflation and changes in interest rates; continuing consolidation in the financial services industry; new litigation or changes in existing litigation; increased competitive challenges and expanding product and pricing pressures among financial institutions; impact of any natural disasters, including earthquakes; effect of governmental supervision and regulation, including any regulatory or other enforcement actions; legislation or regulatory changes which adversely affect First Pacific Bank’s operations or business; loss of key personnel; and changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies. The Company does not undertake, and specifically disclaims any obligation to update any forward-looking statements to reflect occurrences or unanticipated events, or circumstances after the date of such statements except as required by law.

— Summary Financial Table Follows —